30 Jul 2020

The recent California Air Resources Board zero-emissions truck mandate is a windfall for trucking companies

The California Air Resources Board (CARB) recently passed Resolution 20-19 which mandates that by 2045, all new trucks sold in the state must meet Zero Emissions Vehicle standards. Read our previous article to learn the details of this new rule and when it will apply to your operations (and keep in mind that the rule could apply to you even if you are located outside California - Oregon, Washington, Colorado, Hawaii, North Carolina, Washington DC, Maryland, Delaware, New Jersey, Pennsylvania, New York, Rhode Island, Connecticut, Massachusetts, Vermont, and Maine have all adopted similar rules). While there will certainly be costs to come into compliance, there’s some good news: upgrading to a ZEV fleet could actually significantly increase your profits. It requires careful planning, and Actual can help you chart the right course.

You probably have several questions, including:

What do your fleet options look like? Are there going to be ZEV trucks out there that meet your needs?

How do you fit the capital expense (CapEx) to purchase ZEV trucks and install ZEV infrastructure fit in your budget?

How will the new rule affect the health of your business today and in the future?

What does the long term viability of your business look like if you keep your existing fleet?

To begin with the trucks, while there are just a few ZEV models available for purchase today, more are being tested on the road and several new models in the early stages of development. By 2024 when the new rules come into effect, there will be a vast array of ZEV trucks available to drive off the lot.

A number of companies are in the late stages of testing and have already started to deliver ZEV trucks for use across classes and mission needs

What about the capital expense? If you’re a fleet operator, you’re probably very concerned about how the cost of buying ZEVs and installing ZEV infrastructure (e.g. charging stations, batteries), will impact your business. The cost to buy a new EV truck might motivate you to delay switching your fleet to ZEV trucks until the very last moment. Fortunately, the ZEV transition can actually add revenue if you know how to plan for it. You might want to consider transitioning to ZEV trucks as soon as they hit the market instead of waiting for regulations to mandate it.

There are several ways to make operations with ZEV trucks cheaper than with diesel.

Revenue from carbon credits can balance out the cost of electricity. Several states have robust carbon credit markets and trading systems, such as California's Low Carbon Fuel Standard (LCFS). These allow you to create credits as you charge and operate your ZEV trucks, then sell them on the exchange to buyers who are falling short of meeting their CO2 emissions caps. Historically, the revenue generated by carbon credits can balance or even surpass the cost of electricity powering your operations.

You can get tax credits for producing power, and revenue from selling it into the grid. California and many other states which have adopted CARB rules are well suited for solar, wind, geothermal, and other renewable energy generation plants. This enables net metering, where excess power is sold to the grid when trucks aren’t charging, and renewable energy credits (RECs) and investment tax credits (ITCs) at all times. Similarly, batteries can be used to purchase power during off-peak periods and be used as a source of reserve during periods of high demand, reducing the electric cost per kWh.

States provide substantial rebates for new charger sites. A number of states have adopted significant emission reductions goals or adopted CARB rules outright. For example, California aims to reduce emissions by 40% below 1990 levels by 2030. To meet these goals, states offer generous incentives for installing chargers, in some cases up to 80% of the installation costs, provided that certain conditions are met. But these incentives are due to be reduced more quickly than the cost of chargers are expected to fall, so it pays to act soon.

Local utility companies may subsidize the cost of electrical upgrades and installation. Utilities are searching for new ways to effectively balance the grid during times of excess renewable production. Charging large trucks and bus fleets during these times can be a win-win, providing the utility with much needed instantly scalable demand while providing truck operators with cheap electricity that would otherwise go to waste due to curtailment.

Your sites may be in tax-advantaged locations such as qualified opportunity zones. Depending on the location of your facilities, customers, and routes, you may be able to take advantage of Qualified Opportunity Zone tax incentives. These minimize the tax due on certain project incomes, and leveraging this could be quite significant, but it requires careful planning to execute properly.

Other operators will need charging too. Not every ZEV truck operator will invest in their own infrastructure, and many loads will take trucks out of range of their home base. You can open up your site for paid charging for other operators, increasing utilization of your hardware, capturing additional carbon credits, and defraying upfront and fixed operating costs.

Cities and counties want more chargers in disadvantaged communities. Charger deserts are pervasive throughout the country. Many cities have resolved to solve this problem before EVs become pervasive and have passed budgets including significant subsidies for private and publicly accessible chargers located within low-income communities. These subsidies go hand-in-hand with 3rd party revenue, and can be enhanced by careful site design and marketing.

Clearly there are many ways to make a switch to ZEVs pay off, but these options are complex. Several states are following CARB rules and there’s a good chance you’re affected. At the same time, local and utility incentives, the value of carbon credits, renewable energy credits, and production credits all vary based on where you’re operating. Different operators have different mission requirements too, such as daily miles or typical mission radius - there’s no one-size-fits all. Like doing your taxes, it’s very easy to leave money on the table.

Beyond monetary benefits, reducing your emissions may help with permitting, EIRs, and the granting of variances as your operations grow. And over time, there will likely be costs associated with not shifting to ZEVs including pollution-scaled VMT, access to express lanes, tolls, and ZEV-only zones.

Actual can help. It’s key to perform a full analysis of the exact scenario of your business: routes, utility rates, incentives and tax credits, fleet, customer needs, and customer profiles. Actual has the expertise, partners, and tools to craft a strategy that works for your fleet and customers, and can help monitor operations to ensure that your targets are hit once you’re up and running. Contact us today and we can help.

Actual gives infrastructure originators, investors, and other stakeholders confidence as they model and track the cost, impact, and outcomes of sustainable and net-zero infrastructure projects. Visit www.actualhq.com or contact us to learn more about how our digital-twin based models can help unlock new savings and revenue streams for your projects.

Follow Actual on Twitter and visit our blog to learn more about our other projects and perspectives.

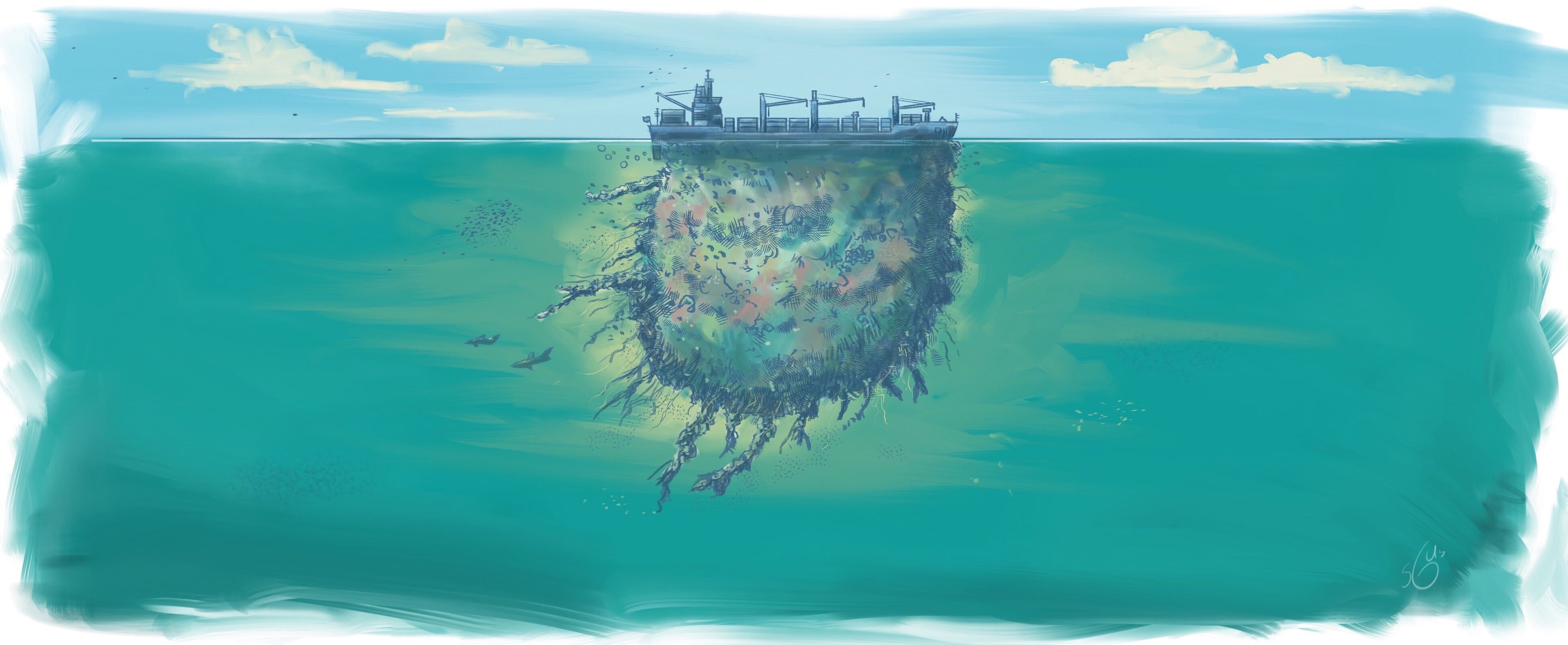

Acknowledgements: Thanks to John Barna Jr., Theresa Johnson and Travis Mason for providing feedback on this article. Illustration by Stefan Gustafsson.

More recent blog posts

28 Sep 2023

ACTUAL Brings Sustainability Transformation Platform to United Nations Global Compact

Dr. Karthik Balakrishnan

+2 more

ACTUAL joins largest corporate sustainability initiative in the world to contribute to the development, implementation and disclosure of responsible business...

19 Dec 2022

Turning over a New Leaf: How FEMA is Addressing Gaps in Tribal Nations’ Disaster Preparedness Planning

Genevieve Olsen

In the wake of increasingly frequent and powerful natural disasters, many Native American tribes and organizations have been vocal about...

19 Dec 2022

To Reach Net-Zero, We Need to Talk About the Maritime Industry

Genevieve Olsen

When we think about reducing GHG emissions, we often think of what’s on land or in the air. But what...